Flood Zones, Noise, and Crime: What Area Reports Can Reveal to UK Homebuyers [2025 Guide]

Buying a home? Learn how area reports reveal risks like flood zones, noise pollution, and crime rates. This 2025 UK guide explains why they matter and how to use them before making an offer.

Why Area Reports Are Essential for Homebuyers

When buying a property most first-time buyers focus on the house itself—size condition and price. But here’s the reality: where you live can impact your quality of life just as much as the property you buy.

That’s where area reports come in. These detailed assessments combine official data on flood risks noise pollution and crime rates along with other local insights to help you make an informed decision.

In 2025 lenders insurers and savvy buyers are increasingly relying on these reports to avoid costly surprises. This guide explains what area reports can reveal why they matter and how to interpret them.

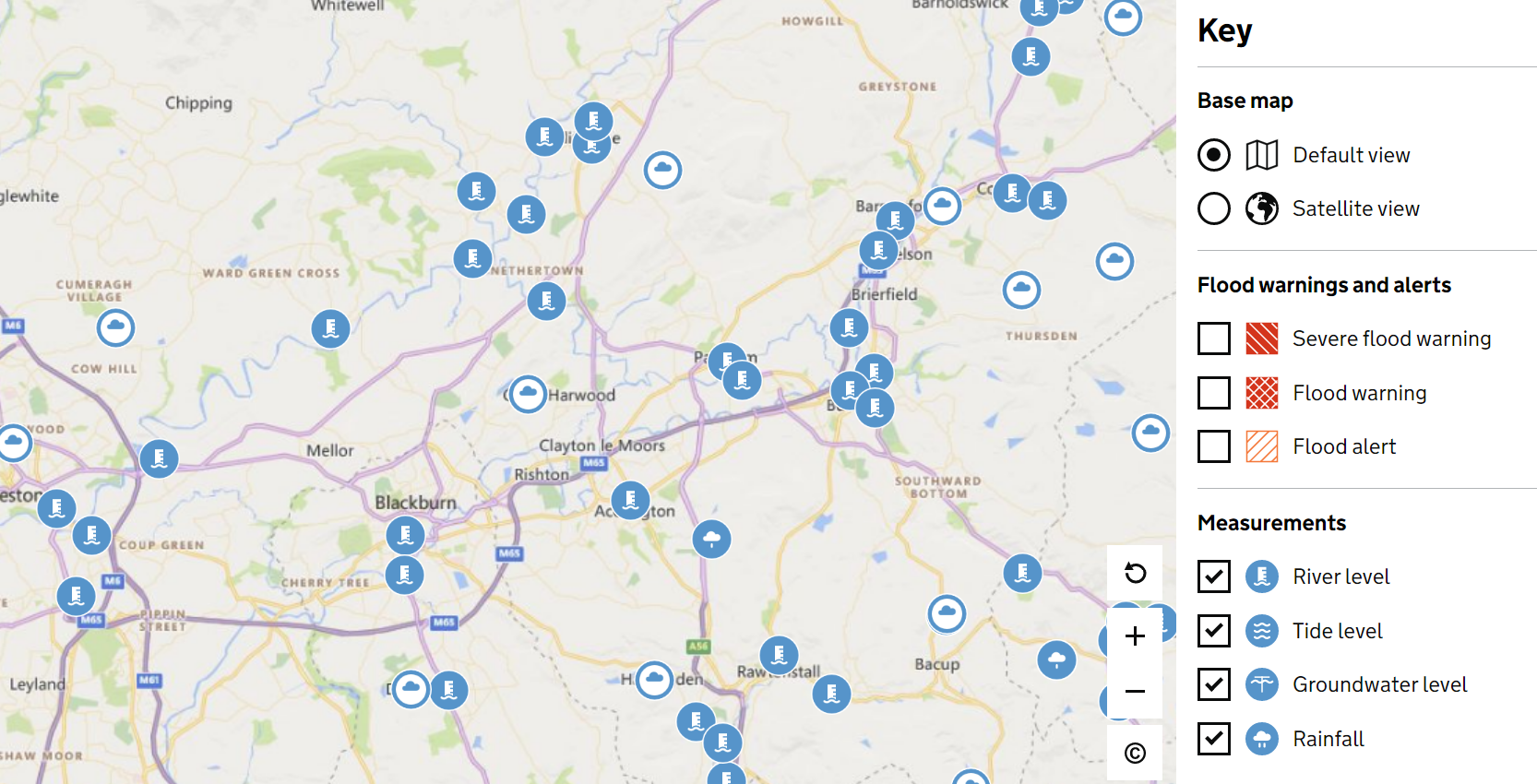

Flood Zones: Understanding the Risks

Flooding is one of the biggest environmental risks for UK homeowners.

What Area Reports Show:

Flood Zone Categories (1–3): Zone 1 = lowest risk Zone 3 = highest.

Types of Flooding:

River flooding (fluvial)

Surface water flooding (pluvial)

Coastal flooding

Groundwater flooding

Historical Data: Past flooding incidents near the property.

Why It Matters:

Insurance Costs: Properties in higher flood zones face higher premiums—or may be excluded from some policies.

Mortgage Approval: Some lenders are cautious with high-risk flood areas.

Property Value: Flood risk can reduce long-term desirability.

Tip: Always check if the property is covered by the Flood Re scheme (which caps insurance costs for homes at risk).

Tip: Always check if the property is covered by the Flood Re scheme (which caps insurance costs for homes at risk).

Noise Pollution: More Than a Nuisance

Noise can affect your comfort sleep and even long-term health.

What Area Reports Show:

Proximity to Major Roads and Railways

Airports and Flight Paths

Industrial or Commercial Sites

Nightlife Hotspots

Why It Matters:

Quality of Life: Persistent noise reduces comfort and peace.

Resale Value: Properties near airports motorways or clubs may be harder to sell.

Legal Protections: Area reports may flag whether the area is in a designated noise action zone.

Tip: Visit the property at different times of day (rush hour late evenings weekends) to experience noise levels first-hand.

Tip: Visit the property at different times of day (rush hour late evenings weekends) to experience noise levels first-hand.

Crime Rates: Safety and Resale Considerations

Area reports often include official crime statistics.

What Area Reports Show:

Types of Crime: Burglary antisocial behaviour violent crime theft.

Trends Over Time: Whether crime is rising or falling locally.

Comparisons: How the area compares to regional or national averages.

Why It Matters:

Safety: High crime rates can affect your sense of security.

Insurance Premiums: Riskier postcodes often face higher contents insurance costs.

Resale Appeal: Buyers with families may avoid high-crime neighbourhoods.

Tip: Always compare crime statistics with nearby areas—figures can look alarming without context.

Tip: Always compare crime statistics with nearby areas—figures can look alarming without context.

Other Insights Area Reports Can Provide

Air Quality: Important for health especially near main roads.

Schools and Ofsted Ratings: Crucial for buyers with children.

Local Amenities: Shops GPs transport links and green spaces.

Socio-Economic Data: Employment levels demographics and future development plans.

Why Area Reports Are Valuable for Buyers

Negotiation Power – If risks are identified you may negotiate a lower price.

Mortgage & Insurance Clarity – Lenders and insurers may require risk data before approving.

Long-Term Planning – Helps you choose an area that suits your lifestyle.

Peace of Mind – Ensures there are no nasty surprises after moving in.

Should You Pay for an Area Report?

Some data (like flood maps or crime stats) is free online. But comprehensive area reports collate everything into one place often with professional analysis.

Cost: £30–£70 depending on provider.

Value: High—especially if you’re buying in an unfamiliar area or investing long-term.

Final Thoughts

Area reports give buyers a 360-degree view of the neighbourhood covering risks like flood zones noise levels and crime rates —as well as lifestyle factors like schools and transport.

For a first-time buyer in 2025 investing in one can mean the difference between choosing a home that suits your lifestyle and finances—or ending up with hidden problems that cost thousands.

Bottom line: Always review area reports before exchanging contracts.

Bottom line: Always review area reports before exchanging contracts.

Editorial Standards & Expertise

WiseNest Editorial Team

Our expert editorial team consists of seasoned technology professionals, business strategists, and digital transformation specialists with over 15 years of combined experience in helping businesses navigate the digital landscape.

This content is optimized to answer these questions comprehensively.

What is an area report when buying a house?

It’s a document that provides detailed information on environmental, social, and safety factors in the property’s location, including flood zones, noise levels, and crime rates.

How much do area reports cost?

Usually between £30 and £70, though some data is available free from government websites.

Do lenders check flood zones?

Yes. Lenders and insurers assess flood risk when deciding mortgage approval and insurance premiums.

How accurate are crime statistics in area reports?

They are based on official police data but may need context (e.g., comparing with neighbouring areas).

Do area reports cover noise pollution?

Yes. They flag major roads, railways, airports, and nightlife zones that could impact living conditions.

Do they also show schools and amenities?

Yes—many reports include Ofsted ratings, local facilities, and socio-economic data.

Join 10,000+ Smart

First-Time Buyers

Get expert homebuying guidance, AI-powered document analysis, and step-by-step support for your first property purchase.

Growing community

Already have an account? Sign in here

Related Articles

Continue exploring our insights and tips

![What Is Indemnity Insurance and When Might You Need It? [2025 UK Buyer’s Guide]](https://a.storyblok.com/f/335762/2560x1707/d026575128/what-is-indemnity-insurance-scaled.jpg)

What Is Indemnity Insurance and When Might You Need It? [2025 UK Buyer’s Guide]

Buying a home in the UK? Discover what indemnity insurance is, when it’s needed, typical costs, and how it protects buyers and lenders from legal risks in property transactions.

![What Surveyors Don’t Check: Common Misunderstandings Every UK Homebuyer Should Know [2025 Guide]](https://a.storyblok.com/f/335762/352x240/c7bfdabdfb/survey-female-352x240-jpg.webp)

What Surveyors Don’t Check: Common Misunderstandings Every UK Homebuyer Should Know [2025 Guide]

Thinking of getting a house survey? Learn what surveyors don’t check, the most common misunderstandings, and what extra inspections UK homebuyers may need in 2025.

Should You Get a Drainage Survey When Buying a Home?

Thinking of buying a house? Learn why a drainage survey can save UK buyers thousands in repairs. Discover costs, benefits, red flags, and whether it’s worth it in 2025.